Options trading simplified.

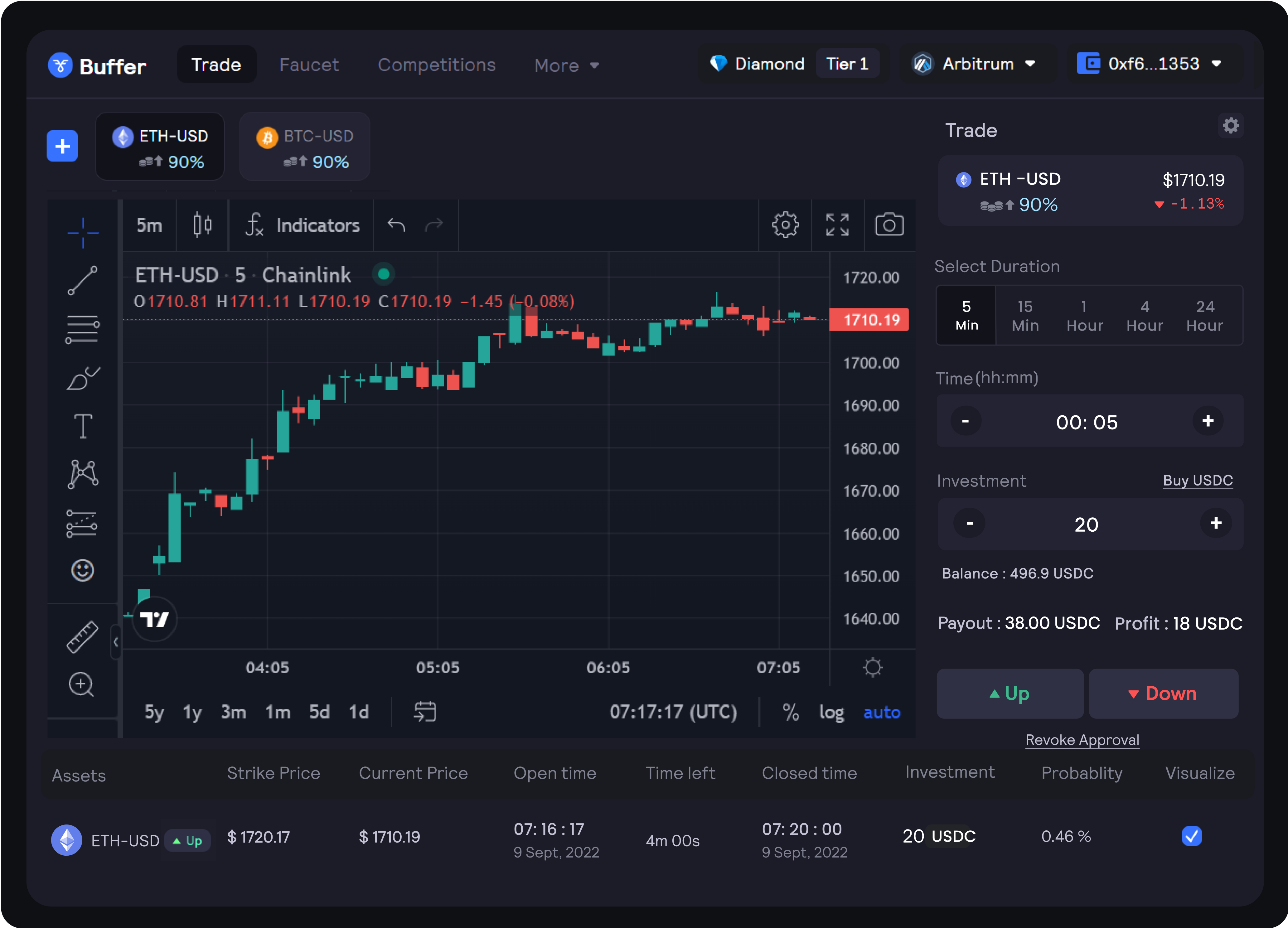

Buffer Finance is a non-custodial, exotic options trading platform built to trade short-term price volatility and hedge risk of high-leverage positions.

Trade Forex

Trade Crypto

Trade Commodities

24x7 Trading

Non-custodial

No Signups Required

Powered By

Key Features

Trade Defined Outcomes

Trade with a defined risk-reward ratio without the risk of liquidation

Simple and gamified

Trade short-term price volatility of any market simply by selecting up/down

Access diverse markets

Trade market volatility of crypto, forex, stock completely on-chain

Non-custodial & Trustless

Trade directly from your wallet against a decentralized price feed without the risk of any scam wicks.

Our Two Token Ecosystem

Optopi Collection

A collection of 8,888 NFTs on Arbitrum to build a happy, cohesive community. Minting an NFT

unlocks membership to the Buffer Prime Club and other exclusive benefits depending on rarity.

unlocks membership to the Buffer Prime Club and other exclusive benefits depending on rarity.